Our primary service is similar to that of a fund manager. Yet rather than stock picking, we’re selecting the rare collectibles that present the highest value potential for our clients.

We recommend to our clients the best quality rare collectibles at the right price. We uncover areas of the market where current dynamics suggest the greatest likelihood of future growth in values.

We are the only service provider offering our clients a comprehensive collectibles portfolio management service they can fully rely upon. From initial purchases through to a successful exit. We are dedicated to building lifelong client relationships which can extend across generations. We provide a tailored service to all our clients to meet their specific needs. All clients have a direct contact line with their personal account manager.

Contact Head of Collections1. We put considerable effort into detailed research for each item we handle and ensure our descriptions are the most comprehensive and accurate.

2. We love to bring the story behind every item we sell to life through our regular emails and videos to our c.20,000 highly engaged subscribers, and 100,000+ social media followers.

3. We cherish building a lifetime relationship with every one of our clients, investing the time to help them achieve their goals.

4. We are passionate and determined to make collecting accessible to everyone and to showcase to the world the wonder of collecting rare items.

When you become a Paul Fraser Collectibles client, you receive first-class service from day one.

Your dedicated collectibles portfolio manager will contact you straight away to discuss your aims, your budget and the areas which interest you the most.

They will then use this information to create a portfolio tailor-made to your requirements.

Throughout your relationship with us your manager will always be on hand to answer your questions, provide you with valuations, recommend new acquisitions and help you keep track of the market.

We pride ourselves on the quality of our service – which is why so many of our clients come to us through personal recommendations.

Personalised Recommendations.

Building a strong personal relationship with every one of our clients is fundamental to how we operate. It's a key component to help you assemble the strongest possible portfolio.

We understand that every collection is a unique reflection of the collector. Every investor has different objectives, whether it's enjoying early retirement or leaving a lasting legacy for their family.

So as you build your portfolio, every piece we recommend to you is carefully selected to suit your requirements.

If you have a 'wish list' of pieces you'd like to own, we'll help you fulfil it. Whether it's the autograph of your childhood hero, a specific model of a vintage watch, or the final rare stamp to complete your collection, we'll use our knowledge and contacts to source you the finest examples at the best prices available.

Valuations.

Throughout your collecting journey with us, you'll receive detailed annual valuations of your portfolio, and each individual piece within it. Your account manager will provide you with commentary on the progress of your portfolio, and advise you on strategies going forward based on the time frame of your assets.

We also offer free, no-obligation valuations for all collectors looking to sell their rare items.

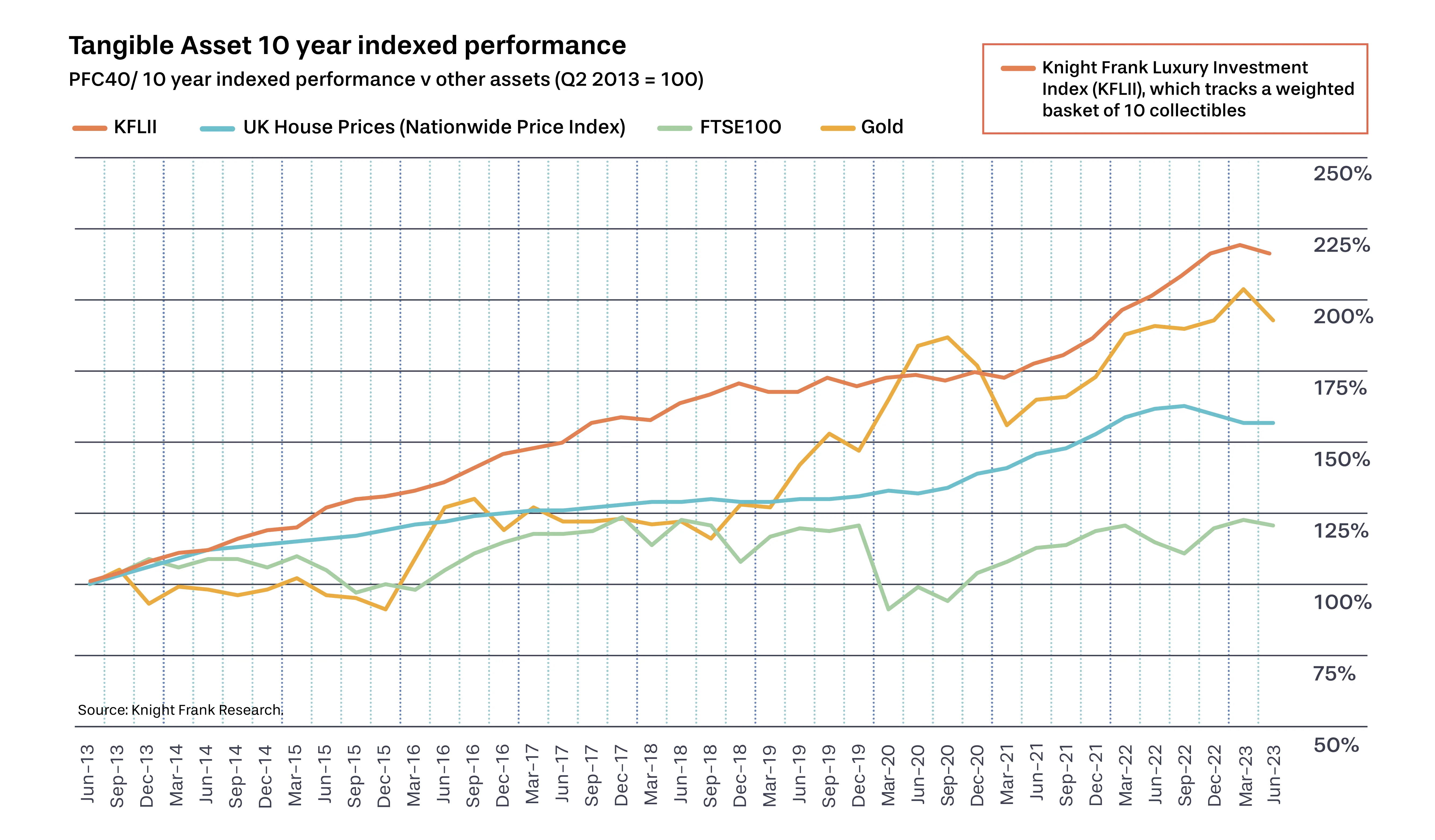

Knight Frank Luxury Investment Index

The chart below demonstrates the performance of a weighted basket of 10 collectibles against UK Housing Prices, the FTSE100 and Gold over a period of 10 years. Collectibles have achieved long-term growth in a steady climb. And continue to be a choice option for high-net-worth individuals and their families.