Your free guide to investing in rare collectibles

WHY INVEST IN RARE COLLECTIBLES?

To grow your wealth: +10% per annum compounded since 1950

To safeguard your wealth: When the stock market plunges, the value of collectible tangible assets historically stays strong

To diversify: The world’s richest invest an average 10% of their portfolio in collectibles

DOWNLOAD OUR FREE INVESTMENT GUIDE TO FIND OUT MORE

DON’T MISS OUT: 3 KEY REASONS TO INVEST IN RARE COLLECTIBLES RIGHT NOW

Surging market: The online collectibles market (excluding eBay) is forecast to double to £20 billion ($30 billion) over the next 3 years

DISCOVER 10 REASONS TO INVEST NOW – DOWNLOAD OUR INVESTMENT BROCHURE FOR FREE

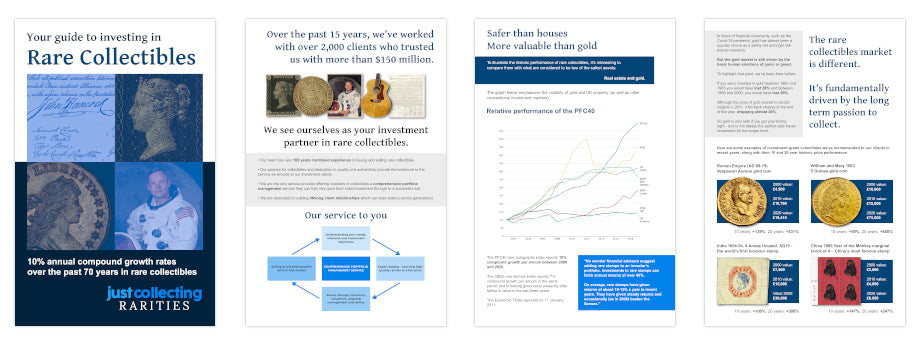

RELATIVE PERFORMANCE OF STAMPS, COINS & AUTOGRAPHS (PFC40 Autograph Index) vs TRADITIONAL INVESTMENTS

The PFC40 rare autographs index reports 10% compound growth per annum from 2000-2020

The GB30 rare stamps index reports 7% compound growth per annum in the same period. And is looking good value presently after falling in value in the last three years. On average rare stamps have given returns of about 10 to 15% a year in recent years

The graph emphasises the volatility of gold and UK property as well as other conventional investment markets

WHY INVEST WITH PAUL FRASER COLLECTIBLES?

Our mission is simple: to help you profit from buying and selling rare collectibles

Expertise: Our team of experts has a combined 250 years' experience in the collectibles sector. Our founder, Paul Fraser, has been investing in collectibles since 1977

DOWNLOAD OUR FREE GUIDE TO INVESTING IN COLLECTIBLES

HOW TO CONTACT US

If you would like to learn more about this unique investment opportunity, please contact us today: