The March Gestion Vini Catena fund, which is managed by Spanish bank "Banca March" began investing in companies involved in wine production in December last year.

Since then they've seen a 9% gain in the value of their investment. Over the same period, the FTSE 100 saw a decrease of 3.7% whilst on average hedge funds have seen a decline of 0.2%.

Jose Luis Jimenez, the creator and managing director of the March Gestion fund explained the decision:

"Wine is such an alternative investment, not too correlated to the stock market; it has limited supply and fast-growing demand from emerging countries."

The new found global interest in investing in fine wine has certainly had a positive effect on the market over the last year.

According to the Liv- Ex index, which tracks the price movement of the 100 most sought after fine wines, the period of January to June this year saw an overall gain in the value of the index of almost 24%.

The Bordeaux index which focuses on the value of 85 investment grade wines from the region also gained 22% in the eight months since January.

Chateau Chaval Blanc 2006 |

And it's a market that continues to see impressive prices for fine wines at auction.

In February, Sotheby's saw the remarkable sale of a Chateau Cheval Blanc 2006.

The lot had been given a pre sale estimated price of £3,600 ($4,900).

Yet the wine sold for £16,100 ($21,400) which was more than four times the estimated price. With this wine highly rated by critics, an investment now could see equally impressive returns over the next decade.

For those with a bigger budget, wines like the four bottles of Côte de Nuits, Domaine de la Romanée-Conti vintage 1990 which sold in the same month for £49,000 ($78,000) offer an excellent return on an investment.

This price was almost twice the £25,000 ($40,000) pre auction estimate.

More recently at Sotheby's in July 2010 a dozen bottles of a 1982 vintage Chateau Lafite came up for sale with an estimated price of £16,000 - 21,000 ($26,000- 35,000).

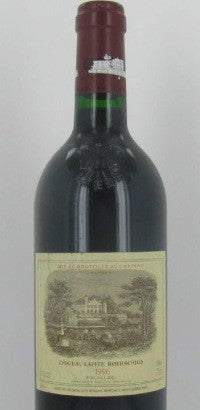

The 1982 Lafite Rothschild |

Described by renowned wine critic Michael Broadbent as "impressively deep and comparatively youthful" a bidding war for the case of wine saw it eventually sell for £30,400 ($45,600).

An investment in the 1982 Lafite is likely to see impressive returns for any wine collector in the coming years.

October 2006 saw the biggest ever auction of wine at Acker's in New York with sales of over £18 million ($24 million), but in recent years the fine wine market has become truly global.

Last weekend saw Asia's biggest ever wine auction. The "Imperial Cellar" sale held in Hong Kong was the second biggest of all time, with over 19,000 bottles sold in 1,820 lots.

The event broke a series of records with many items selling above expectations with around 97.3% of all lots sold and a total of over £12.1 million ($18.15 million).

And these figures are down to the growth of fine wine investment in countries like China.

The People's Republic had their first ever fine wine auction in November 2009, in an event that clearly marked the increasing demand for investment grade fine wine in the Far East.

The Beijing auction saw 93% of lots sold for a total of £815,000 ($1.3 million).

China currently represents the world's fifth largest wine consumer, behind France, Italy, the US and Germany and it's certainly having a knock-on effect in fine wine investment.

Increasing interest has seen greater competition for rare fine wine collections which has helped to drive up auction prices.

The 1982 Chateau Petrus |

At Sotheby's in Hong Kong in December 2009 a six litre bottle of Chateau Petrus 1982 sold for £62,000 ($94,000) - a world record price for a sale of its kind.

Yet Asian involvement in fine wine investment is not simply limited to auctions in the Far East.

September last year saw the sale of the late Belgian billionaire Charles Albert Frere's collection of over 3,000 bottles of Bordeaux and Champagne in London.

The event raised around £1.1 million ($1.6 million) with 454 lots up for sale and it was estimated that approximately 50% were sold to Asian buyers.

In fact Sotheby's worldwide fine wine auction figures indicate that 57% of their total sales have come from Asian buyers, with Europe and North America accounting for 20% each.

And since 2008, the Chinese government have removed duty taxes on wine in Hong Kong, with the city now set to rival London and New York as one of the centres of fine wine investment.

Yet this is only the start, as Australia too is seeing increasing prices for fine wine at auction.

Where once some Australian vintages were labelled "uncollectable", increasing numbers of collectors and investors from all over the globe are targeting rare bottles from the continent, that date back to the last century.

In September 2009, a collection of 40 different vintages of Australia's most expensive fine wine sold for £96,000 ($144,000) at auction. This was thanks to what one auctioneer labelled:

"The increasingly passionate race among wine collectors for the dwindling remnants of Australian ultra-fine wine heritage"

The Penfolds Grange collection featured every vintage from 1951 to 1990. The price equates to around £2,400 for each vintage.

This is a relative bargain considering that the 1990 vintage alone was the first outside of France or California to be awarded "Wine of the Year" by Wine Spectator magazine.

With a flight from Melbourne to Hong Kong taking just 9 hours, the growing Eastern market could soon be bolstered by the boom in Australian fine wines, meaning an investment down under now could see impressive returns at future auction.

So whilst investors in the traditional financial markets face the next few months with some degree of uncertainty, there's plenty to look forward to for collectors of fine wine.

September will see the 40th year of Sotheby's sale of rare wines. And if last year's event which saw total sales figures of £2.2 million is anything to go by, collectors could be in for a treat.

And with fine wine offering an investment that can be treasured and enjoyed by collectors and investors alike the future is looking refreshingly bright for this particular alternative investment.

- Learn how you can get pleasure and profit from fine wine investments

- Click here for all the latest Wine, Whisky and Spirits news

Join our readers in 189 countries around the world - sign up for your free weekly Collectibles Newsletter today