If the art market is a bellwether for the collectibles sector, then fresh research from Deloitte is worth your attention - whatever your collecting interest.

Because the financial consultant's latest Art and Finance Report, released last month, reveals that investment potential is an increasingly important factor for art buyers.

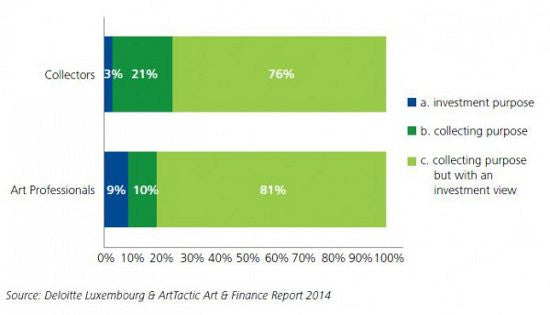

The company's 2012 report found that 53% of art collectors considered the investment potential of a piece when making a purchase. In 2014 that figure has risen to 76%.

'Why are you/your clients buying art?' the report asked |

The report, which canvassed private banks, art collectors and art professionals, also discovered that 9% of the average wealthy individual's portfolio is devoted to collectibles. That is a considerable figure, in my view - and evidence that collectibles are gaining mainstream acceptance.

What's more, wealth managers in the US are expecting that 9% figure to increase as more buyers consider the sector's money making potential.

So why are we seeing increasing numbers of wealthy individuals investing in art and collectibles?

Two key reasons:

Diversity and profit

A diversified financial portfolio is a safe financial portfolio.

The economic crash of 2008 hit a lot of us hard. Many investors saw huge chunks of their savings wiped overnight.

Those with a varied portfolio could weather the storm of such market volatility. And tangible assets such as art, or stamps, or historical documents can't suddenly lose value in the space of an hour like shares.

In essence, increasing numbers of buyers are looking to art and collectibles as a way to store wealth and ride out any bumps along the way.

But this is more than simply about parking capital.

With Deloitte's report indicating that compound annual returns of contemporary art range from 10.5-14.9%, there is money to be made from high-end collectibles if you know how.

And that goes for rare stamps, autographs, books, classic cars - you name it.

Our first edition books index demonstrates what I'm talking about - as does our autograph index.

Next steps

So if investing in collectibles sounds like something you're interested in, what to do?

I would humbly suggest that you get in touch with the high-end collectibles experts. Either by phone +44 (0)117 933 9500 or email info@paulfrasercollectibles.com

We can talk about your collecting interests, investment goals, and how much you're looking to spend.

And I will be there to guide you every step of the way - if you want.

And, need I say it, there will be absolutely no obligation on your part to do anything.

Thanks for reading,

Paul

PS. To get a flavour of the kind of thing you can invest in with us, click here.

PPS. I've had my "investment" hat on today - but please don't forget there's a further reason to own great collectibles: it's incredibly enjoyable.