Crisis, what crisis? Such a question might be asked by Christie's. The international auctioneer's art sales netted a total of $5.7bn last year - 14% more than in 2010.

This is further evidence that, while the euro zone is in turmoil, wealthy and super-wealthy collectors are getting fed up with traditional assets and turning to tangible alternatives like art.

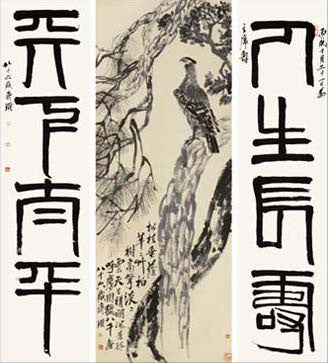

Big contributing factors to Christie's art auction success include China's art buyers. Chinese collectors are getting more and more involved in the markets, and this is driving up prices.

But Christie's figures won't be news to the compilers of the well-respected Mei Moses index. Its figures, gathered from analysis of Christie's and Sotheby's auctions, show that global sales of all types of art went up by 10.2% last year.

In particular, the Mei Moses recorded that Chinese art grew in value by 20.6% in 2011.

|

|

Elsewhere, top US auctioneer James D Julia recently commented that Chinese collectibles have risen in value "by 2,000%-5,000%. Some Chinese objects which regularly sold in 2003 for $20,000-30,000, today will bring $500,000-800,000 or more."

Earlier this week, London mayor Boris Johnson commented that the largest-ever crowd turnout for Year of the Dragon celebrations in the UK's capital "shows the way the world economy is going."

He definitely has a point, as China continues to assert itself at the world's top art auctions.

And no wonder, considering that there are more than 960,000 millionaires in the People's Republic - a figure which is rising year on year.

Christie's released its figures yesterday. Good timing, too, as the auctioneer is gearing up for a number of new art auctions in the coming week.

Watch this space for more news from the Chinese and global art markets.