Rare collectible assets have the potential to increase in value out performing traditional investments over the long term. Not only can they be financially rewarding, they offer a link to a person past or present, a connection to a time and a place and can be personally rewarding. These collectible assets include historical documents with signatures, space, movie, political and music related items, as well as personal items owned or worn by a famous individual.

It offers you the opportunity to own some of the world's rarest objects and become an honoured custodian of history. As the renowned publishing magnate and collector, Malcolm Forbes famously stated:

“None of my other investments give me the joy that autographs do, because they make me feel that I am holding a piece of history in my hands.“

You can build an inspiring collection featuring figures you admire from the worlds of politics, science, aviation, military history, literature, and popular culture.

You can own significant documents, letters and manuscripts which changed the course of history and shaped the modern world we live in.

These pieces can give you a lifetime of pride and pleasure of ownership. They can form a magnificent display in your home. And they can serve as valuable assets in a diversified portfolio.

Since 2000 the overall value of the PFC40 Index, which tracks the prices of rare autographs across the market, has increased by 714%, at an average annual rate of 32%.

The signatures of many individual figures, such as Neil Armstrong, Steve Jobs, George Harrison and Prince William have grown by upwards of 1,500% over the same period. These figures show that the finest rare autographs have consistently out-performed the Dow Jones, the FTSE100 and even the price of gold for more than two decades.

If you have a keen interest in the past, historic autographs and memorabilia could be the ideal area of the rare collectibles market for you.

Knight Frank Luxury Investment Index

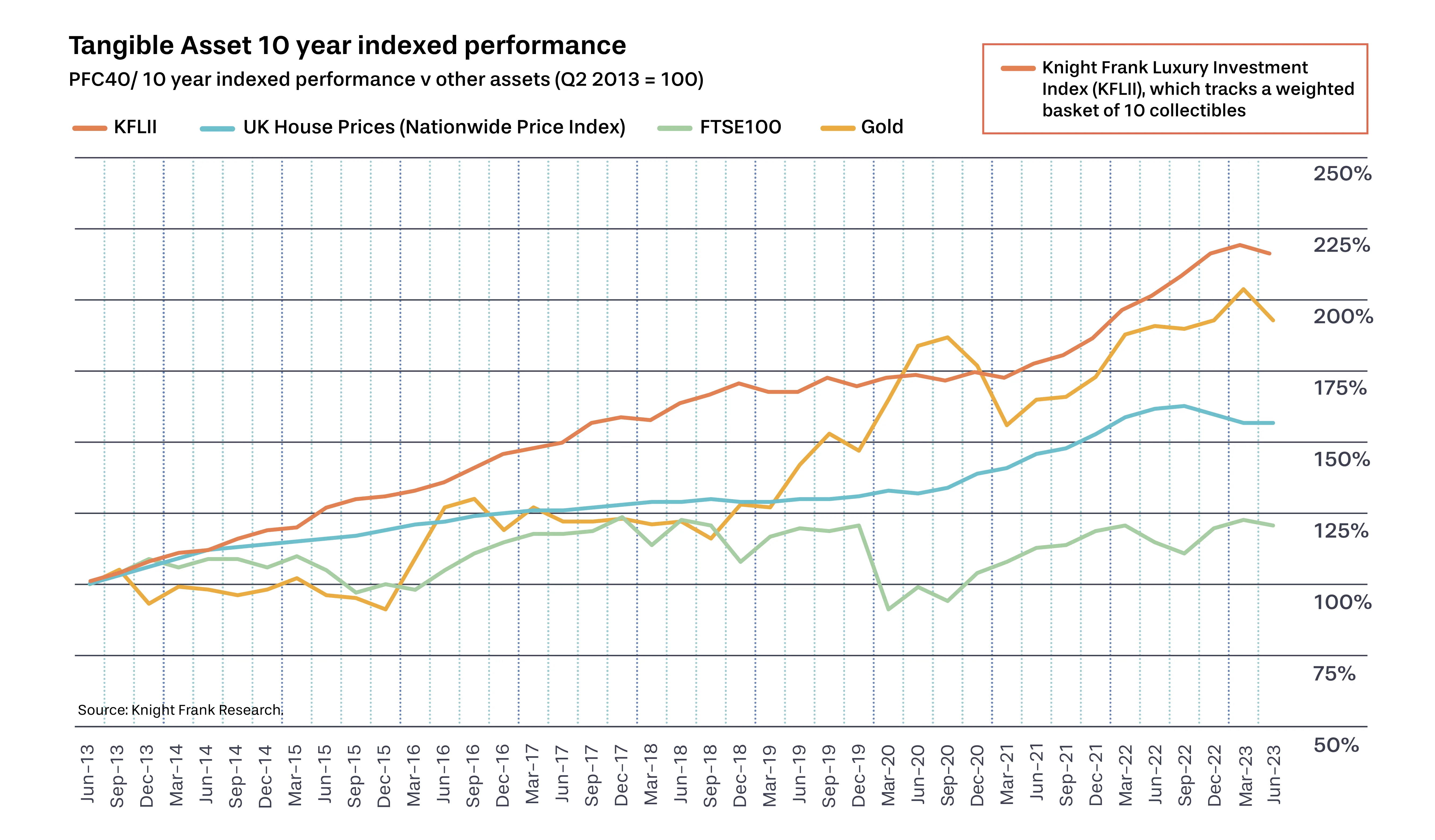

The chart below demonstrates the performance of a weighted basket of 10 collectibles against UK Housing Prices, the FTSE100 and Gold over a period of 10 years. Collectibles have achieved long-term growth in a steady climb. And continue to be a choice option for high-net-worth individuals and their families.

George Washington's personal copy of the US Constitution & Bill of Rights

Sold in 2021 for $9.8 million

Albert Einstein's handwritten note on his secret to happiness

Sold in 2017 for $1.6 million

1980 Apple II instruction manual signed and inscribed by Steve Jobs

Sold in 2021 for $787,484

A signed copy of the Beatles' Album Sgt. Pepper's Lonely Hearts Club Band

Sold in 2013 for $290,000

A Marilyn Monroe signed photograph to her husband Joe DiMaggio

Sold in 2023 for $240,000